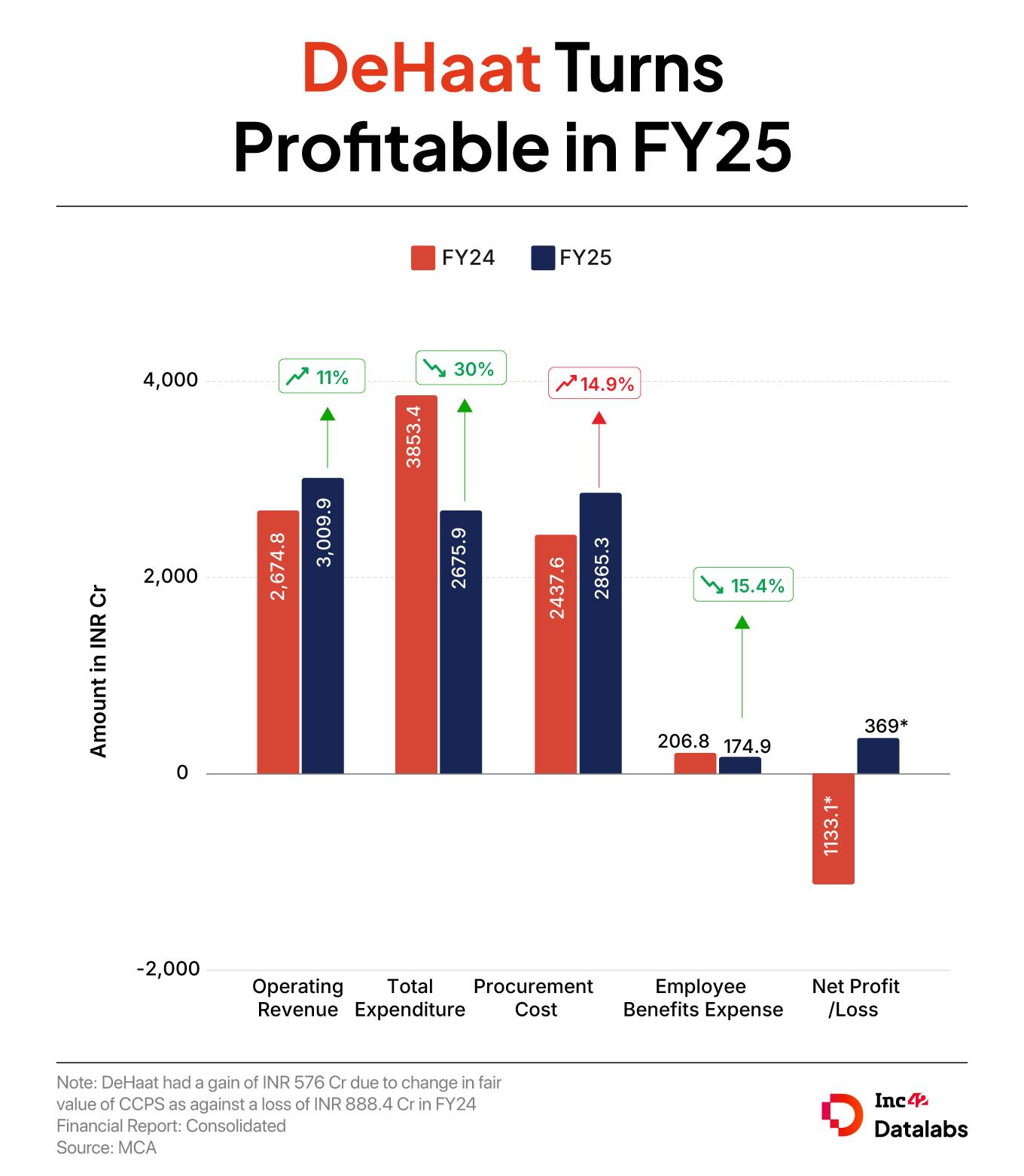

Peak XV Partners-backed agritech startup DeHaat turned profitable in the financial year 2024-25 (FY25), reporting a consolidated net profit of INR 369 Cr as against a loss of INR 1,133.1 Cr.

However, the profitability came on the back of non-cash gain of INR 576.1 Cr in FY25 due to change in fair value of CCPS as against a loss of INR 888.4 Cr under the head in the previous fiscal year. Without this gain, the startup would have posted a loss of about INR 207 Cr in FY25.

Meanwhile, its operating revenue jumped 11% to INR 3,009.9 Cr during the year under review from INR 2,674.8 Cr in FY24.

Founded in 2012 by Shashank Kumar, Shyam Sundar Singh, Amrendra Singh, Adarsh Srivastava, and Abhishek Dokania, DeHaat is a full-stack agritech platform that offers services like sale of agri inputs, expert advisory, and agri-exports.

The omnichannel startup earns revenue by selling agricultural inputs (seeds, fertilisers, pesticides) to farmers, and earns commissions by sourcing produce directly from farmers and selling it to institutional buyers, traders, exporters, and processors.

Besides, it offers other value-added services. While most crop advisory and farming guidance is free, DeHaat charges a premium for offerings like soil testing, customised farm planning, and pest management. It also partners with financial institutions to provide credit and crop insurance to farmers.

The startup operates more than 8,000 one-stop DeHaat Centres, collectively covering over 80,000 hectares of farmland.

As per its MCA filing, DeHaat earned INR 606.7 from sale of agricultural input products and services and INR 2,392.7 from sale of agricultural output products and services in FY25.

Including other income of INR 30.9 Cr, the startup’s total income stood at INR 3,040.8 Cr in FY25 as against INR 2,720.3 Cr in the last fiscal.

Cofounder and CEO Kumar told Inc42 in July that FY25 revenue growth was due to high-margin private label sales, exclusive partnerships for agri-input distribution, and an increased focus on exports, storage and food processing.

He said that DeHaat exported goods worth INR 430 Cr to 32 markets in FY25, while private label sales accounted for nearly 25% of its revenue in the fiscal.

Sources also told Inc42 that DeHaat turned profitable in the first quarter (Q1) of FY26. It reported an EBITDA of INR 5 Cr to INR 10 Cr in the June quarter, and was eyeing full year profitability in FY26, they added.

Despite the growth in its top line, DeHaat managed to trim its total expenditure by 30% to INR 2,676.9 Cr in FY25 from INR 3,853.4 Cr in the previous fiscal year.

Procurement Cost: DeHaat’s cost of trading goods increased nearly 15% to INR 2,865.3 Cr from INR 2,437.6 Cr in FY24.

Employee Benefit Expenses: The startup’s spending on employees, which includes salaries, incentives, gratuity, and more, declined 15% to INR 174.9 Cr in FY25 from INR 206.8 Cr in the previous fiscal year.

Transport and Freight Changes: DeHaat’s expenses under this head increased 41% to INR 112.7 Cr in FY25 from INR 79.6 Cr in FY24.

DeHaat last raised INR 200 Cr (around $23.4 Mn) in venture debt from Trifecta Capital in April. It is soon planning to raise another funding, its founder told Inc42.

The post DeHaat Posts INR 369 Cr Profit In FY25 On Back Of Non-Cash Gains appeared first on Inc42 Media.

You may also like

'Inappropriate touch during consultation': Indian-origin doctor arrested in California, cops asks victims to come forward

AYURFARM 2025 certificate course on Medicinal Herb cultivation concludes at AIIA, New Delhi

Punjab Police brings BKI terrorist Parminder Singh Pindi to India after securing extradition from UAE

Bhopal News: Police Headquarters Raises Financial Aid To Kin Of Deceased Police Personnel After 8 Years

Venezuela Fury beams with joy as she celebrates with family after getting engaged at 16