India's relatively smaller ports among the major state-owned maritime facilities are beginning to show stronger growth momentum, backed by better connectivity, capacity upgrades, and gains paced by demand for specific commodities.

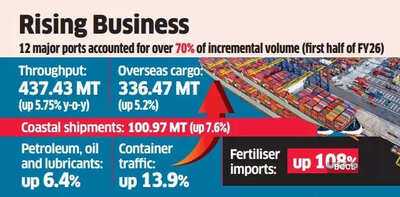

Data from the Ministry of Ports, Shipping and Waterways show that in the first half of FY26, the country's 12 major ports handled 437.43 million tonnes (mt) of cargo, up 5.75% from 413.65 mt in the same period last year.

Overseas cargo rose 5.2% to 336.47 mt, while coastal shipments increased 7.6% to 100.97 mt. Fertiliser imports recorded the steepest rise at 108%, container traffic grew 13.9% and petroleum, oil and lubricants (POL) maintained a 29% share with 6.4% growth.

While Paradip, Deendayal and Jawaharlal Nehru Port Authority (JNPA) continued to lead in absolute volumes, smaller state-run ports, such as Mormugao, Chennai and New Mangalore reported stronger percentage growth.

Mormugao's cargo throughput rose 14.5%, Chennai grew 8% and New Mangalore 7.26%.

The pickup at smaller ports was not due to congestion at larger ones, said Pratik Mundhada, Director, India Ratings & Research.

"No cargo shift was observed in the first half of FY26. The growth was commodity specific, with coal at Mormugao, iron ore at New Mangalore and containers at Chennai. A pre-tariff surge in US-bound container shipments also lifted volumes at Chennai and JNPT in the second quarter," he said. "In the first half of FY26, India's 12 major ports' cargo growth was spearheaded by JNPT, Paradip, Kandla and Kolkata, which together accounted for over 70% of the incremental volume," said Mundhada. "Smaller ports like Chennai, Mormugao and New Mangalore also recorded significant gains, supported by capacity expansion, berth mechanisation and better rail connectivity that improved cargo-handling efficiency."

Goa's Port of Coal

At Mormugao, coal handling revived after restrictions were relaxed following new pollution-control investments.

"Cargo growth at Mormugao has been primarily driven by the relaxation of coal-handling restrictions after capital expenditure aimed at curbing pollution," said Maulesh Desai, Director at CARE Ratings.

Investments were made on building enclosed warehouses and covered sheds for coal, which is a dirty commodity with a high ash content. Such infrastructure helps prevent dust emissions and makes handling more compliant with environmental norms.

"At Chennai, the increase in cargo volumes is largely due to a 12% rise in container traffic supported by inventory build-up ahead of an anticipated tariff hike," Desai said. "Meanwhile, growth at New Mangalore is mainly due to a surge in coastal cargo, benefiting from a low base effect."

Paradip remained the top performer in absolute volume at 76.78 mt, followed by Deendayal at 74.37 mt, JNPT at 49.63 mt, Vizag at 43.09 mt and Mumbai at 35.15 mt.

Fertiliser imports have surged sharply, linked to lower domestic output of diammonium phosphate (DAP). "The rise in fertiliser imports is likely driven by lower domestic production of DAP, one of India's key phosphatic fertilisers," said an industry expert. "Since domestic DAP output depends heavily on imported raw materials like phosphoric acid and ammonia, the government has asked PSUs to step up imports."

Fuel, Ores

The expert added that crude oil imports have also risen, while iron ore volumes dropped 7.77% year on year. New Mangalore, however, saw an uptick that could be tied to new capacity or diversion.

Another expert said the overall growth pattern remains uneven, but not without potential.

"Kamarajar, VOC and Cochin ports haven't really moved the needle in terms of growth," the expert said.

"Fertiliser cargo has done well, and Kolkata and Paradip have shown healthy momentum in containers. But about seven out of twelve major ports, nearly 60%, have reported growth of less than 5%, which shows that the overall uptick is still uneven."

In September 2025, cargo movement gathered further pace with total throughput rising 11.5% year on year to 73.13 mt. Deendayal handled 13.08 mt, followed by Paradip and JNPT.

Data from the Ministry of Ports, Shipping and Waterways show that in the first half of FY26, the country's 12 major ports handled 437.43 million tonnes (mt) of cargo, up 5.75% from 413.65 mt in the same period last year.

Overseas cargo rose 5.2% to 336.47 mt, while coastal shipments increased 7.6% to 100.97 mt. Fertiliser imports recorded the steepest rise at 108%, container traffic grew 13.9% and petroleum, oil and lubricants (POL) maintained a 29% share with 6.4% growth.

While Paradip, Deendayal and Jawaharlal Nehru Port Authority (JNPA) continued to lead in absolute volumes, smaller state-run ports, such as Mormugao, Chennai and New Mangalore reported stronger percentage growth.

Mormugao's cargo throughput rose 14.5%, Chennai grew 8% and New Mangalore 7.26%.

The pickup at smaller ports was not due to congestion at larger ones, said Pratik Mundhada, Director, India Ratings & Research.

"No cargo shift was observed in the first half of FY26. The growth was commodity specific, with coal at Mormugao, iron ore at New Mangalore and containers at Chennai. A pre-tariff surge in US-bound container shipments also lifted volumes at Chennai and JNPT in the second quarter," he said. "In the first half of FY26, India's 12 major ports' cargo growth was spearheaded by JNPT, Paradip, Kandla and Kolkata, which together accounted for over 70% of the incremental volume," said Mundhada. "Smaller ports like Chennai, Mormugao and New Mangalore also recorded significant gains, supported by capacity expansion, berth mechanisation and better rail connectivity that improved cargo-handling efficiency."

Goa's Port of Coal

At Mormugao, coal handling revived after restrictions were relaxed following new pollution-control investments.

"Cargo growth at Mormugao has been primarily driven by the relaxation of coal-handling restrictions after capital expenditure aimed at curbing pollution," said Maulesh Desai, Director at CARE Ratings.

Investments were made on building enclosed warehouses and covered sheds for coal, which is a dirty commodity with a high ash content. Such infrastructure helps prevent dust emissions and makes handling more compliant with environmental norms.

"At Chennai, the increase in cargo volumes is largely due to a 12% rise in container traffic supported by inventory build-up ahead of an anticipated tariff hike," Desai said. "Meanwhile, growth at New Mangalore is mainly due to a surge in coastal cargo, benefiting from a low base effect."

Paradip remained the top performer in absolute volume at 76.78 mt, followed by Deendayal at 74.37 mt, JNPT at 49.63 mt, Vizag at 43.09 mt and Mumbai at 35.15 mt.

Fertiliser imports have surged sharply, linked to lower domestic output of diammonium phosphate (DAP). "The rise in fertiliser imports is likely driven by lower domestic production of DAP, one of India's key phosphatic fertilisers," said an industry expert. "Since domestic DAP output depends heavily on imported raw materials like phosphoric acid and ammonia, the government has asked PSUs to step up imports."

Fuel, Ores

The expert added that crude oil imports have also risen, while iron ore volumes dropped 7.77% year on year. New Mangalore, however, saw an uptick that could be tied to new capacity or diversion.

Another expert said the overall growth pattern remains uneven, but not without potential.

"Kamarajar, VOC and Cochin ports haven't really moved the needle in terms of growth," the expert said.

"Fertiliser cargo has done well, and Kolkata and Paradip have shown healthy momentum in containers. But about seven out of twelve major ports, nearly 60%, have reported growth of less than 5%, which shows that the overall uptick is still uneven."

In September 2025, cargo movement gathered further pace with total throughput rising 11.5% year on year to 73.13 mt. Deendayal handled 13.08 mt, followed by Paradip and JNPT.

You may also like

Royal Family RECAP: Meghan Markle accused of trying to overshadow William in Brazil

Police look for culprit of arson attack on war memorial days before Remembrance Sunday

Alan Carr has won Celebrity Traitors - BBC bosses have a serious problem on their hands

Aryna Sabalenka calls for urgent meeting as Iga Swiatek warns 'players are not happy'

Celebrity Traitors RECAP: Alan Carr breaks down in tears during bombshell finale